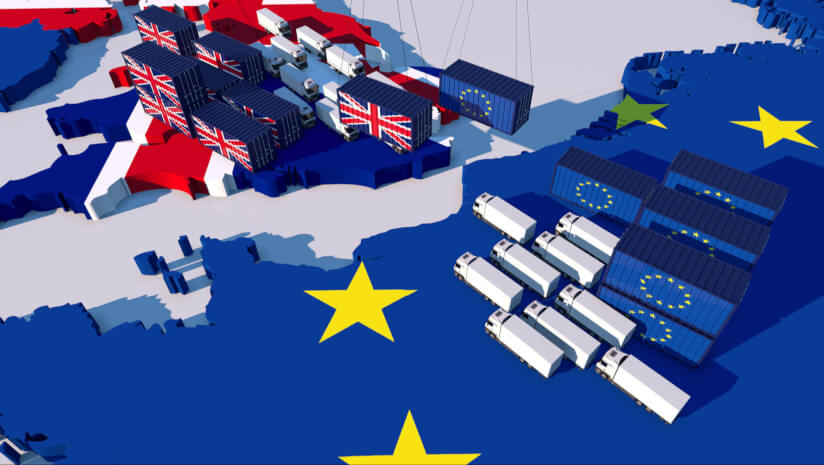

EU imports to the UK fell by almost a quarter (23.6 %) in the first six months of this year, compared with the first half of 2023.

Data from the UK Food and Drink Federation shows that exports to other countries remained relatively unchanged at 0.8 per cent, but are still not as impressive as those to the EU at 59 per cent.

This is why more than half of manufacturers say [the UK's] relationship with the EU is a priority for the new [UK Labour] government, the FDF says.

What are the reasons for a decline in UK food exports?

As more bureaucracy is introduced, such as additional checks, trading British food and drink products into the EU becomes increasingly difficult. The second phase of border delays that was introduced in the spring includes this.

Starting this month, new border control fees will increase for businesses and for products such as meat, fish, milk and dairy products.

Stricter controls on fresh produce will be implemented from 1 July. This means that businesses, already burdened by bureaucratic costs and a lack of flexibility, are now facing an even greater administrative burden.

Balwinder Dhoot, Director of Industrial Growth and Sustainability at the UK Department for Trade and Industry, said: “British food and drink businesses are creating brands and products that consumers value not just in their home countries, but around the world.”

However, these figures show that manufacturers are facing increasing barriers to exporting, particularly to the EU.

Which countries can export British food products?

Dhoot challenged the UK government to do more to boost exporter confidence, help businesses expand overseas and compete better, which could include "removing administrative trade barriers", Dhoot said.

The success of trade agreements that reduce red tape has been proven, for example with India. In the first half of the year, exports to India increased by 11.9% to 127 million PS.

The FDF has identified the UAE as a market that could help UK food and drink businesses achieve further growth on top of the 2.4% growth in the first half of 2020.

The FDF says an ambitious deal could lead to significant trade growth, just as the UK-Australia FTA saw exports increase by 7.1 per cent to PS196.7 million.